Heloc tax deduction calculator

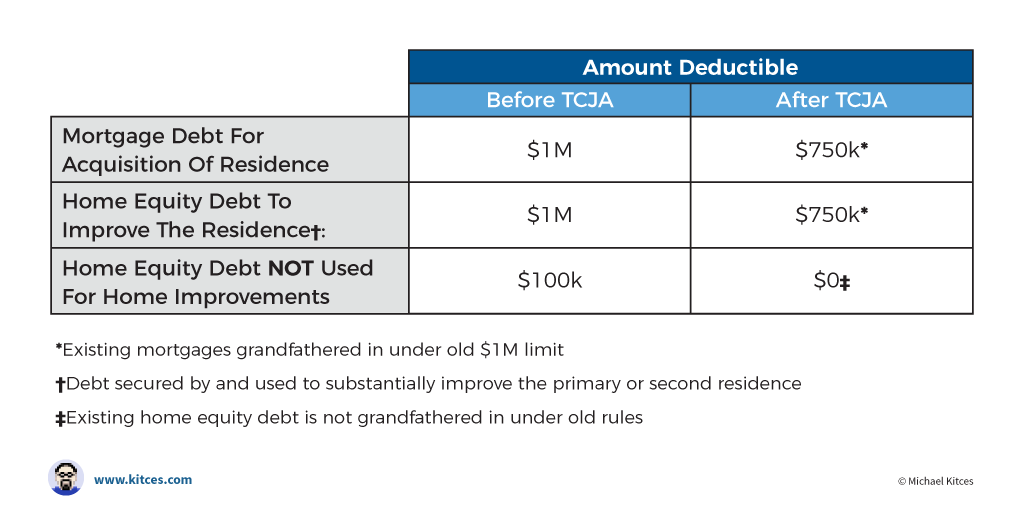

For taxpayers who use married filing separate. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000.

Mortgage Interest Deduction What You Need To Know For Filing In 2022

A home equity line of credit HELOC and a home equity loan both free up cash by accessing the equity you have in your home.

. Your tax savings will be 187 for a home equity loan and 372 for a HELOC. Due to the Tax Cuts Jobs Act which raised the standard deduction many people find it easier and more beneficial to use the standard deduction versus itemize deductions. Any new loan taken out from Dec.

Prime Rate 075. 2022 Federal income tax withholding calculation. Interest on these loans used to be fully tax-deductible but some changes were implemented with the passage of the Tax Cuts and Jobs Act TCJA in 2017.

15 2017 onwardwhether a mortgage home equity loan HELOC or cash-out refinanceis subject to the new lower 750000 limit for deducting. Generally the interest paid on a home equity loan or home equity line of credit HELOC is tax-deductible for borrowers who itemize deductions. Next divide that figure by the value of your home.

Aug 18 2022 Joint filers who took out a home equity loan after Dec. Is a home equity line of credit tax-deductible. In order to deduct the interest paid on a HELOC you must spend the money on improving or repairing the property used to secure the loan.

In both cases the interest charges may be tax. Subtract 12900 for Married otherwise. You paid 4800 in points.

The terms of the loan are the same as for other 20-year loans offered in your area. 15 2017 can deduct interest on up to 750000 worth of qualified loans while single. One of the benefits of homeownership is the availability of a tax deduction for the interest paid on a mortgageFor interest paid on for many.

You can only deduct interest payments on HELOCs if you use the cash for home. Heres how that works with a home valued at 400000 with a loan balance of 300000. So it likely only makes sense to itemize and deduct your property tax if your total deductions exceed the 2022 standard deduction which is 25900 for joint filers or surviving.

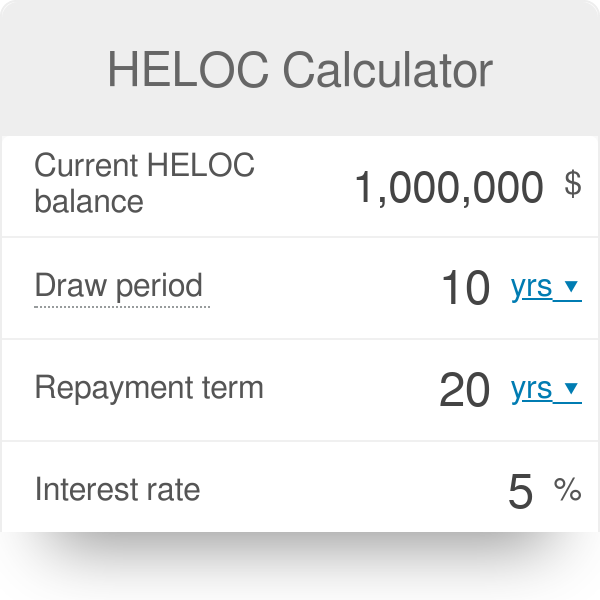

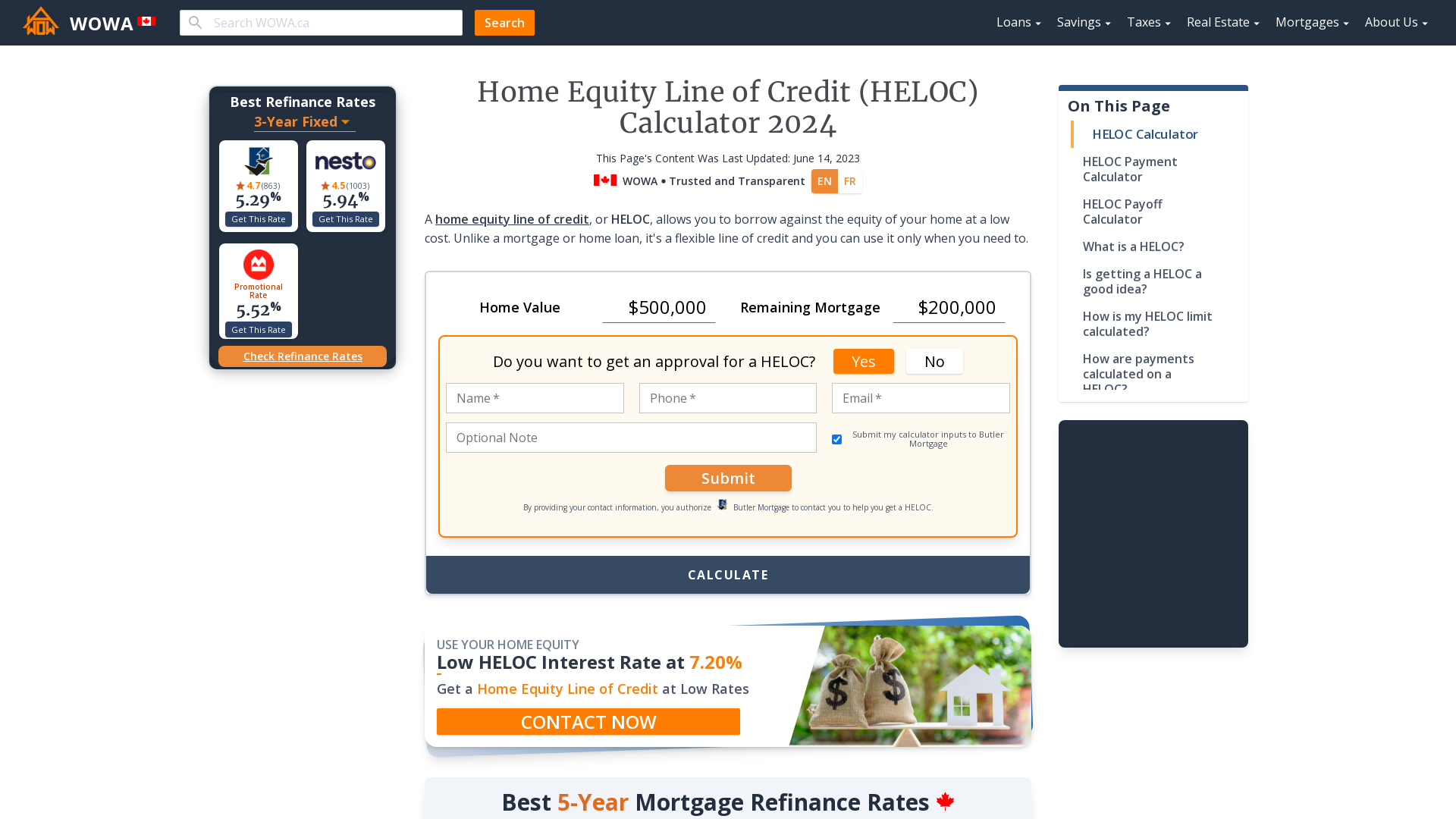

Interest paid on home equity lines of credit aka HELOCs is sometimes tax deductible. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. This HELOC calculator is designed to help you quickly and easily calculate your monthly HELOC payment per your loan term current interest rate and remaining balance.

Additionally if the HELOC is on. Use our home equity line of credit HELOC payoff calculator to find out how much you would owe on your home equity-based line each month depending on different variables. 400000 - 300000 100000.

In 2021 you took out a 100000 home mortgage loan payable over 20 years. Single borrowers may deduct the interest. As of today the Prime Interest Rate is equivalent to a rate of 550 APR and 075 over the Prime Interest Rate is equivalent to a rate of 625.

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

/GettyImages-1148171551-a60119b7ac2c4653b12c48b4e40b2b81.jpg)

Tax Loophole For Deducting Home Equity Loan Interest

Home Equity Loans Credello

Tax Deductions For Home Mortgage Interest Under Tcja

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

When Can I Deduct Health Insurance Premiums On My Taxes Forbes Advisor

Home Ownership Tax Benefits Mortgage Interest Tax Deduction Calculator

Heloc Calculator

How To Estimate Your Taxes To Extend Filing Deadline Forbes Advisor

Home Ownership Tax Benefits Mortgage Interest Tax Deduction Calculator

Can I Deduct Heloc Interest On My Income Taxes Bank Of Hawaii

![]()

Home Equity Line Of Credit Calculator Heloc Qualifier

Heloc Calculator Calculate Available Home Equity Wowa Ca

Tax Deductions On Home Equity Loans Helocs What You Can Write Off

How A Heloc Can Help

Best Current Heloc Rates Calculator Compare Home Equity Loans To Cash Out Refinancing

Is Heloc Interest Tax Deductible Shared Economy Tax